'How Government Built This - Strengthening and Empowering Our People & Culture’ – How Empowerment leads to Innovation

Welcome to “How Government Built This,” a podcast and blog post series developed by the Department of the Treasury’s Bureau of the Fiscal Service Office of Financial Innovation and Transformation (FIT) in collaboration with the American Council for Technology and Industry Advisory Council (ACT-IAC). This series will spotlight trailblazers exploring the intersection of innovation and Diversity, Equity, Inclusion, and Access or DEIA across government. Resources and links mentioned in each podcast will also be available at actiac.org/thebuzz.

Tom Vannoy, Deputy Assistant Commissioner, Wholesale Security Services, Bureau of the Fiscal Service, Department of the Treasury

Tom Vannoy, Deputy Assistant Commissioner, Wholesale Security Services, Bureau of the Fiscal Service, Department of the Treasury

Tom holds an MBA/MS in Information Systems Management and BS in Human Resource Management from the University of Maryland – College Park.

Tom is also the proud Father of a 15 1/2-year-old daughter and 14-year-old son who are primarily raised by Alison (Alie), his very understanding wife. They also have four dogs that are spoiled by various members of the family: Rosie, Snowflake, Hazel, and Maggie. Recent hobbies include reading books about coaching, cycling, and video games.

Tom has been the Deputy Assistant Commissioner for Wholesale Securities Services for nine years where his staff conducts the operations for all Treasury auctions. Tom is a strong advocate for employee development, a strong work culture, and having fun.

What is empowerment? What does it mean for an individual or workforce to be empowered?

Tom believes that empowerment is unique to everyone, so can speak as both an employee and a leader who manages other employees. Looking back to when Fiscal Service’s Do Not Pay program was set up, Tom was a program manager overseeing 3-4 people, and making decisions. He operated independently but wasn’t executing decisions fast enough to keep the program moving on schedule. Tom’s own executives pulled him aside and stressed that providing he wasn’t issuing “dumb” decisions, they trusted him and his decisions. Knowing he had this trust and backing felt incredibly empowering. Looking back to this role, Tom felt the most empowered of any of his roles because of this conversation with his executives.

Tom works to create an environment where his own employees can feel as empowered as he did. In Treasury auctions, where Tom works now, there is a low-risk appetite because of the need for precision. In this constrained environment, empowerment is about clarifying to employees how much risk is acceptable in their work. With this knowledge, employees understand when they can try something new without having to get many approvals and when approvals are not needed. Governance is a good thing, but it can stifle empowerment and discourage innovation and new ideas.

Being empowered positively affected your mental state, but did it also change how you approached your work?

Because of his leadership’s trust, Tom felt in charge and that he was able to make decisions beyond his normal scope of responsibility. Having this confidence in his decisions allowed him to issue timely decisions to keep the program moving in the right direction, rather than having to wait for approval.

Empowerment clearly benefited you as an employee. How did it benefit your leadership and your organization?

Creating the Do Not Pay program resulted from a request by the Office of Management and Budget (OMB). The program had an aggressive timeline, resulting in an entrepreneurial environment. Since Tom was empowered, he was able to make decisions to meet the demands of this tight timeline and keep the program on track.

In a risk averse area like Treasury auctions, how do you balance giving employees autonomy to innovate or take risks in one area with the need to be precise and accept almost no risk in another?

It’s important to be clear and specific when speaking with employees about the culture of the organization and its mission. Tom meets with each employee in their first month on the team to discuss the culture of the Wholesale Securities Services (WSS) organization, whose tagline is “one team, one mission, precisely delivered.”

He explains expectations, values, and behaviors to new employees and collects feedback from his employees regularly. In these conversations he stresses that accuracy and precision are needed in Treasury auctions and delineates what areas or work are more risk tolerant and which are not. For example, in areas such as strategic planning and management, there is more room to take risks because they don’t directly affect the primary business.

Setting clear expectations early also gives an employee the opportunity to quickly determine whether the organization and autonomy they have aligns with their own expectations. If an employee feels that the organization isn’t a good fit for them, Tom will help them find another team that is more aligned with their needs and expectations.

Empowerment is closely tied to employee engagement and being excited to come to work. In a hybrid environment, it can be difficult to feel engaged. How do we overcome this barrier?

Tom is a firm believer in the idea that, “culture eats strategy for breakfast.” For this reason, he is focused on the culture of the organization and incorporating employee feedback when there’s something that can be improved. Engagement in a remote workplace requires leadership to be explicit and up front about expectations and what it’s like to work in the organization. The interview is a two-way street; even as you’re interviewing potential employees, they should be interviewing you.

It's important in a remote environment to have employees feel part of the team and feel trusted. When the pandemic hit, Tom’s team went from being in person, having physical auction rooms, and requiring leadership approval to telework to going fully remote. As he hired new employees into this fully remote environment, he retooled the onboarding process to have these employees feel part of the team and feel trusted.

Looking beyond WSS to the broader organization, the bureau established Fiscal Challenges to present problems and invite employees to form teams to tackle them. Participants were provided with analytical tools and data sets and encouraged to take time to explore. Tom heard great feedback from employees who participated and appreciated the opportunity to learn about something outside their own day-to-day responsibilities. They gained exposure to new tools sets and new colleagues outside their own spheres, and this increased their engagement as their horizons expanded. An important part of engagement and empowerment is creating an opportunity for growth.

What would you say to leaders who are skeptical or afraid of employee empowerment?

It took courage for Tom’s leadership to trust him and his ability to make decisions. Tom has experience working for people who’ve felt comfortable trusting him with autonomy and for people who did not feel comfortable. Leaders must develop this comfort to succeed. As you move up in your career, you become less of an expert and more of your accomplishments are attributable to of the work of the people you oversee, and so it’s important that they feel empowered and supported. Without this culture of empowerment, the organization is fragile and may not continue to succeed after you leave because people have become dependent on you managing everything and issuing every decision. If you can’t get comfortable empowering others as you move up in your career, it’s going to be more difficult to reach the success level you’re used to.

Any final thoughts on engagement and empowerment?

Tom feels strongly that the more engaged your workforce is, the more you’re likely to accomplish. Micromanaging is not a strategy for success. Also, Tom recently heard someone articulate that “belonging” is where Diversity, Equity, Accessibility, and Inclusion (DEIA) intersect. Feeling like you belong and that you are part of an organization is foundational to feeling engaged and feeling empowered.

Fiscal Service recently held a challenge empowering all employees to look at the way we do business, take advantage of some learning opportunities on evaluating a process, and propose recommendations. To get started the following four questions were provided:

How can Fiscal Service improve service offerings to increase accessibility and equity? … think about our customers who are unbanked, those with limitations related to technology, or those with language barriers, to name a few.

How can Fiscal Service improve accounting and reporting? … think about addressing fraud risk, the effective use of data, or something as simple as eliminating/improving the use of a spreadsheet.

What can we do to address data quality, accuracy, and integrity across the enterprise? & think about improvements to how we collect data.

How do we ensure our modernization and transformation work is addressing a customer need/problem? … think about how we deliver training and how we communicate with customers (e.g., reducing the number of touch points and steps in a process for customers).

The following employees were participants of the top two teams.

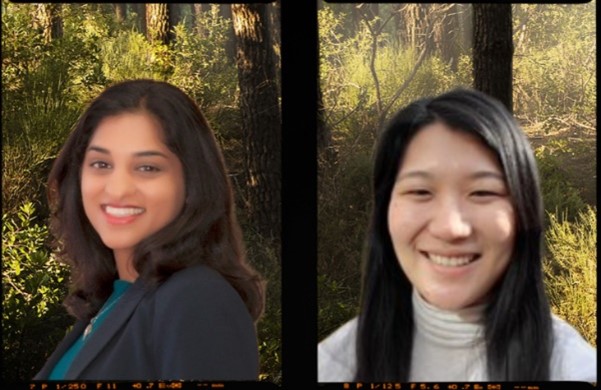

Kuhu Parasrampuria Attorney Advisor, Office of the Chief Counsel and Grace Lim, Management and Program Analyst, Office of the Chief Data Officer

Does this idea of empowerment and engagement resonate with you?

Grace is fairly new to the Bureau of the Fiscal Service, and since day one she has felt empowered by her leadership. It’s important for leadership to establish a culture of empowerment and set an example for the rest of the organization. There is a virtuous cycle or multiplier effect in which empowered employees empower those around them and are more apt to raise new ideas.

We talk a lot about how leaders empower their workforce or how an organization empowers its workforce, but how do employees empower their peers?

When your colleagues speak up or ask challenging questions, they are showing that psychological safety exists in the organization or space. The ability to question is such an important part of being empowered. When you see someone else model this behavior, it gives you the confidence to also raise questions and contribute.

What drew you to the Fiscal Challenge? What made you want to take on this challenge on top of your existing workload?

Kuhu explained that participating in the Fiscal Challenge was an opportunity to do something different from her usual work, specifically finding process improvements in another area of the enterprise. It was an opportunity to network with and meet people out of her circle. Having joined the bureau during the pandemic, it’s been challenging meeting people in a remote and then hybrid environment.

Is there anything from the Fiscal Challenge that you’ve been able to bring back with you after the end of the project?

It’s clear to Kuhu that the bureau values when employees suggest process improvements. Since the end of this Fiscal Challenge, she practices identifying and speaking up about ways to improve processes in her own office. Also, the relationships that Kuhu formed with colleagues in areas outside the Office of the Chief Counsel and the subject matter knowledge that she can tap from these new relationships enables her to work more effectively.

What did you learn about yourselves or your home organizations after stepping out of them to participate in the Fiscal Challenge?

Kuhu learned how to navigate constituencies that would be impacted by her suggestions. When suggesting process improvements, you’re pointing out room for improvement, and it’s possible that the process owners can take that personally. They may feel they or their work is being attacked, but that’s not the intent. It’s important to always be rethinking and reassessing what you do. Kuhu learned how to better secure buy-in from affected constituencies and frame recommendations in a way that audiences would be more receptive.

Grace also feels that the bureau as an organization respects her thoughts and ideas as an employee, and the Fiscal Challenge was one example of that. She had always felt that her own office empowered her, but the Fiscal Challenge was an opportunity to see that empowerment taken to a larger scale at an enterprise level.

Any finals thoughts?

Grace had a fantastic experience participating in the Fiscal Challenge and beyond the Challenge has felt empowered in suggesting new ideas and seeing those suggestions incorporated into existing processes. For Kuhu, the Fiscal Challenge was a great learning opportunity that she hopes to see continue at the bureau and at other federal agencies.

Dave Martie, Fiscal Analyst, Office of Fiscal Projections; Melissa Campisi, Executive Assistant, Wholesale Securities Services; Donald Ricks, IT Project Manager, Program Management Branch

How did you find yourselves on a team together and what was it like working with colleagues from across the organization?

Melissa brought the group together after having worked with both Donald and Dave previously. She had positive experiences with both and immediately thought of them when she saw the Fiscal Challenge and needed to form a team.

How did you land on your project and what was it like tackling this topic that was outside all three of your areas?

Donald relied on his cybersecurity experience to look at how the bureau’s applications are used by customers and other external stakeholders. The team was drawn to the opportunity to learn and collaborate on a topic that was outside but touched on their areas of knowledge. Donald has experience understanding cybersecurity deployments for activities and functions such as logging into a bank account through multifactor authentication. For Dave, this project was more outside his area of knowledge, and so the team divided the work of the challenge in a way that aligned with their respective skillsets. Donald applied his technical knowledge to dive into the details of the project, while Dave focused on presenting the project findings in a way that resonated with audiences. Melissa was somewhere in between Donald and David in her background and role and supported both the testing and presentation sides of the work.

We’ve discussed the benefits of empowerment and employee engagement throughout this episode. What were some additional benefits you encountered?

Dave seized an opportunity to perform a detail outside the bureau at the Department of the Treasury’s departmental offices as an unexpected benefit of participating in the Fiscal Challenge. The detail was in no small part a result of the Fiscal Challenge because an executive who heard Dave brief his team’s findings was impressed by the presentation and took down Dave’s name. When this executive later saw Dave’s resume in the applicant pool for the Fiscal Challenge, he remembered Dave’s presentation and recommended him for the opportunity.

Any last takeaways from participating in the Fiscal Challenge?

Donald sees work in the federal government as being structured and often regimented with a clear path for how to do things and the outcomes you expect. The Fiscal Challenge, on the other hand, was a unique opportunity to do things differently. Donald is reminded of how Elon Musk, CEO of Tesla, will host hackathons for outsiders to compete to try to infiltrate his products. These events are opportunities to determine how vulnerable your applications are. Similarly, in the Fiscal Challenge, Donald’s team was able to analyze and test one of the bureau’s external facing applications to identify potential security vulnerabilities. This will enhance the security of the product and increase customers’ confidence in using the bureau’s applications.

Dave observed that some Fiscal Challenge teams comprised members who belonged to the same office and were analyzing their own office’s processes rather than another area of the bureau. This meant that these teams would be uncovering pain points that could reflect poorly on their own teammates or supervisors. The dynamic discouraged some of these teams from pursuing these analyses. This meant the bureau missed out on an opportunity for these teams to uncover potential pain points and opportunities for improvement. Having formed a team from three different areas, Dave felt that his team did not experience this dynamic. Cross-office collaboration fostered a healthy dynamic both for Dave’s team but also for the entire bureau.