So, You Decided to Automate Your Process with RPA

Date: September 19, 2019

Great news, you are not alone! Being involved with RPA has so many benefits, such as increasing accuracy in a process, boosting employee morale and making way for more stimulating work.

But, the hurdles to make RPA a reality can seem to be a daunting task.

But that doesn't have to be the case! If some preparation is done BEFORE the RPA “Nerds” come knocking on your door, life as you know it may get a whole lot easier, and not to mention more productive.

Let's look at four basic principles (and tips) you should consider before the official time comes to move into the RPA building phase of your process, making your employees (and organization) more productive.

- Documentation — Kind of a given, but before you consider a process to be an automatable one, ask if there is documentation, AND is it up-to-date in an easily understood format. (Not only does this help your organization with personnel turnover, but it helps the RPA developers in their work to make your process able to use RPA. If an RPA developer can’t follow along with the documentation, this can significantly hinder your best intentions of turning a process into an automated one.)

- Audit — This is as much of a given as documentation, but it needs to be clearly stated. Process owners need to have a plan in place to review RPA. Questions you may ask could be:

- “Who will oversee the output of a process checking for accuracy?”

- “Who will document the new automated process and roles that may change with existing work?”

- “What happens in the event the RPA process goes down? Is there a contingency?”

Clearly defining steps taken can be a game-changer over the long haul of this venture.

- Security — Part of the planning phase of RPA (or the prep work) is to meet with security as soon as reasonable. One thing that can bring a process to a standstill, or make an organization back track, is not staying in-line with security standards and guidelines. Once the momentum of automating a process starts, you don’t want to have to stop (or worse move backwards) because security was not involved or overlooked.

- Is RPA the Answer? — Ask if the process you are wanting to automate is truly something that can be automated! When narrowing down a process, you want to be sure and look at tasks that may be something a human must do. In other words, is the specific task (in the process) something a human must decide on, or is it something that is repetitive and the same each time? Can you make a “change” that would enable the process to be automated? Would that change be a simple adjustment, or much more? If nothing else, wait until meeting with the RPA folks. There is a possibility the process can be automated “as is”, but considering not all tasks can be, at least you will be better prepared!

Did you know?

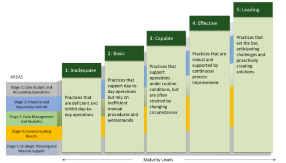

Automation in a financial management organization can be indicative of the maturity of the core budget & accounting operation functions.

To learn more please review the FM Self-Assessment.

Need more innovation tips from FIT? Read our other blogs or join our mailing group. To find out more about the Fiscal Service, visit fiscal.treasury.gov or follow us on LinkedIn and Twitter.

What are common FM processes?

The FM Business Use Cases offer descriptions of

how common financial management processes

are performed.